Strategic Planning & Consensus Suite

Global Promotional Modeling for a Multi-Billion-Dollar Retail Ecosystem

NDA Notice: This project was completed under a non-disclosure agreement. All company names, partner references, data values, and visuals have been anonymized or reconstructed. The work shown reflects the underlying design approach, system architecture, and decision-making process rather than the final production UI.

The Business Context

Promotional planning operated at massive scale:

Multiple partners

Multiple regions

Multiple lines of business

Yet decision-making relied on:

Fragmented Excel models

Manual handoffs

Email-based approvals for compliance

Each function optimized locally, but no system owned the truth.

The Core Problem: A Broken “Handshake”

Through stakeholder interviews and workflow analysis, one pattern consistently surfaced.

The breakdown occurred at the handshake between:

Commercial Ops, who modeled promotional strategies and deal assumptions

Demand Planning, who validated those assumptions against forecasts, supply constraints, and unit targets

Any forecast update triggered a full rework cycle:

Assumptions drifted

Versions conflicted

Finance lacked an auditable trail

This “rework loop” slowed approvals and increased financial risk late in the planning cycle.

Design goal: Digitize the handshake to synchronize collaboration and compress the Global Finance approval window.

My Role & Team

Role: Lead Product Designer

Scope: System architecture, UX, data modeling, validation logic

Team: Product, Engineering, Finance, Commercial Ops

Platform Type: Enterprise financial planning system

Design Process

How I approached the problem

Strategy: Reframing Planning as Scenario Management

Rather than forcing teams into a single “correct” plan, I reframed planning around explicit scenario modeling.

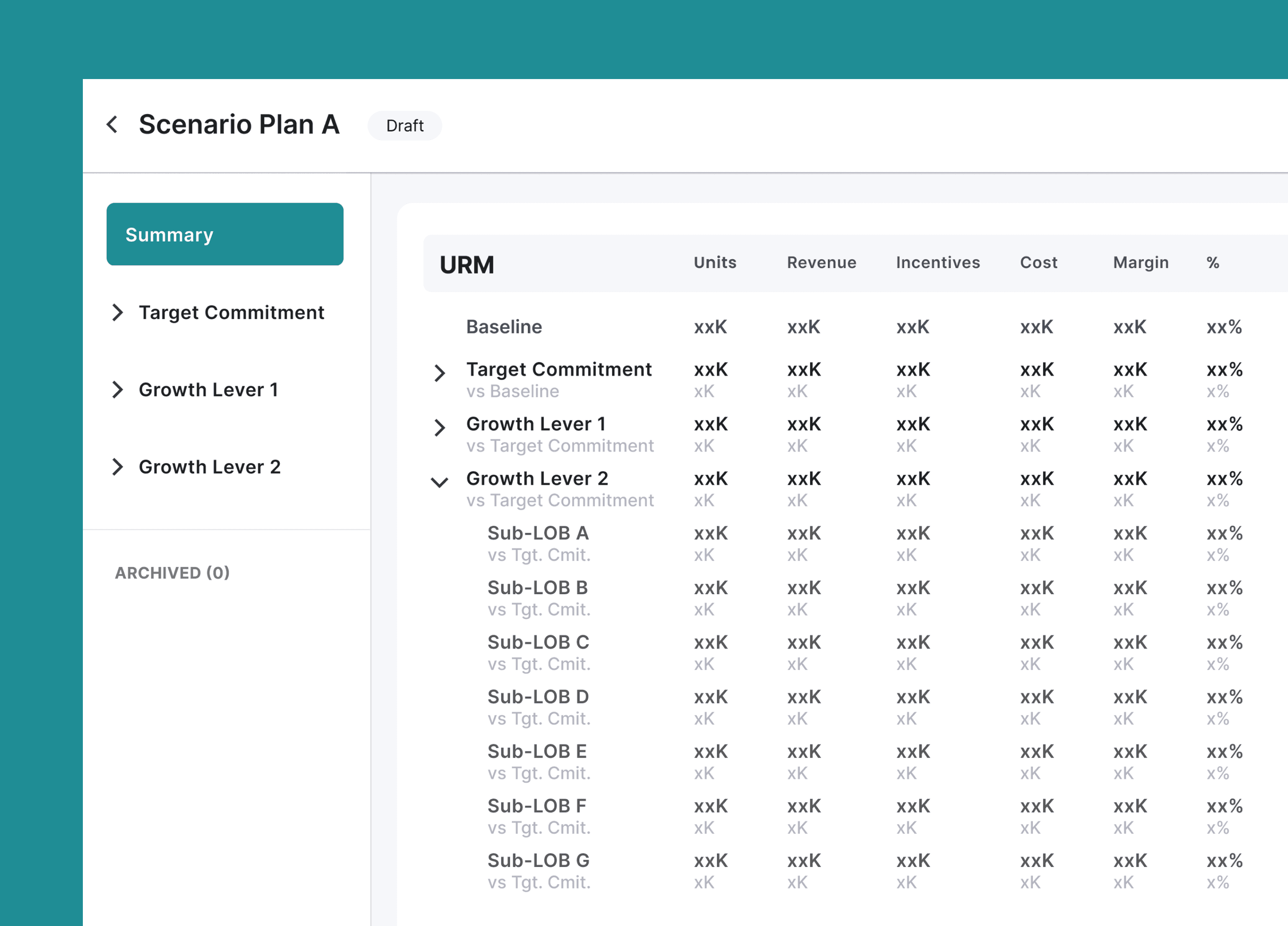

Scenario-Based Architecture (M1)

Plans were anchored to a finalized weekly forecast, with structured sensitivity tiers:

Organic Baseline: No promotions

Target Commitment: Finance-aligned plan

Growth Levers (1 & 2): Aggressive upside scenarios

This approach separated confidence from optionality, enabling productive debate without breaking forecast alignment.

Demand Planning validated each scenario explicitly—turning assumptions into shared, auditable decisions.

Solving Data Integrity at the Source

The Input Problem

Sales teams across partners, regions, and LOBs created promotions using flexible, free-text titles and subtitles.

This supported local sales needs—but produced inputs that were impossible to model consistently.

Design Decision: Standardize What Matters

Instead of forcing rigid upstream behavior, I introduced a Promo Card schema that:

Normalized only the fields required for financial modeling (discount, duration, dates)

Preserved original sales language as metadata

Maintained traceability across systems

This abstraction aligned operational reality with financial rigor.

Designing for High-Cognitive-Load Modeling

Elasticity Workspace (Price × Volume)

Price elasticity modeling is inherently risky:

Uplift assumptions directly impact revenue and margin

Errors propagate quickly

To manage this, I applied progressive disclosure:

Weekly data visible by default

Daily detail revealed only when needed

This preserved analytical depth while reducing cognitive overload.

I also architected a dedicated integration point for AI-driven elasticity recommendations, enabling future evolution without redesign.

System Guardrails & Validation Logic

A critical part of my role was defining how the system protects itself from bad data.

I authored a 50+ rule field-level logic document covering:

Real-time validations (e.g., mix totals must equal 100%)

Numerical constraints and formatting

Blocking vs. warning states

Multi-stage confirmation flows

These guardrails ensured financial integrity while maintaining user trust.

Scaling to Leadership Strategy (M2)

The Executive Need

Leaders needed to:

See total regional P&L

Understand cross-LOB cannibalization

Evaluate scenario tradeoffs holistically

Design Solution

I designed a consolidation dashboard that allowed leaders to:

Mix and match scenarios across partners and LOBs

See aggregate impact recalculate in real time

This shifted conversations from “Which numbers are correct?” to “Which strategy do we choose?”

Multi-Dimensional Margin Analysis

Finance and leadership users required dense, flexible analysis:

Rapid scope changes (partner, LOB, sub-LOB)

Instant switching between company and partner profit

Customizable metrics without rebuilding views

I designed a dynamic view engine with:

Metric toggles (20+ KPIs)

Pinned comparisons for context preservation

Reusable analysis templates

Here, density was a feature—not a flaw.

Compliance, Locking, and Outcomes

SOX Reality

Final approvals occurred via email for legal compliance.

The platform needed to reflect—not replace—this reality.

Consensus Lock

Once approved:

Data was frozen

Versions were preserved

The system became Finance’s record of truth

Impact

Significant reduction in rework cycles

Increased confidence in promotional planning

Scalable foundation for AI-driven optimization

Key Learnings

Enterprise UX is decision infrastructure, not just interfaces

Data density can be a competitive advantage for expert users

Legal and finance workflows must shape product design

AI only works when foundational schemas and rules exist